How SEPA DD works

What is SEPA The Single Euro Payments Area (SEPA) is a European Union initiative enabling cashless euro payments through credit transfers and direct debits. The European banking and payments industry launched SEPA with backing from national governments, the European Commission, the Eurosystem, and other public authorities. What is SEPA Direct Debit SEPA Direct Debit is a payment system that allows merchants to collect euro-denominated payments directly from customer accounts in the SEPA region (consisting of 36 countries and associated territories). SEPA DD can be therefore used to collect recurring payments for subscription renewals. SEPA DD mandate To collect payments directly from a customer’s account, a SEPA mandate must be created. This mandate can be set up through an A2A (account-to-account) payment using for example iDEAL or Bancontact. When making their initial purchase, customers authorize the merchant to charge their account.Recurring payments with SEPA DD

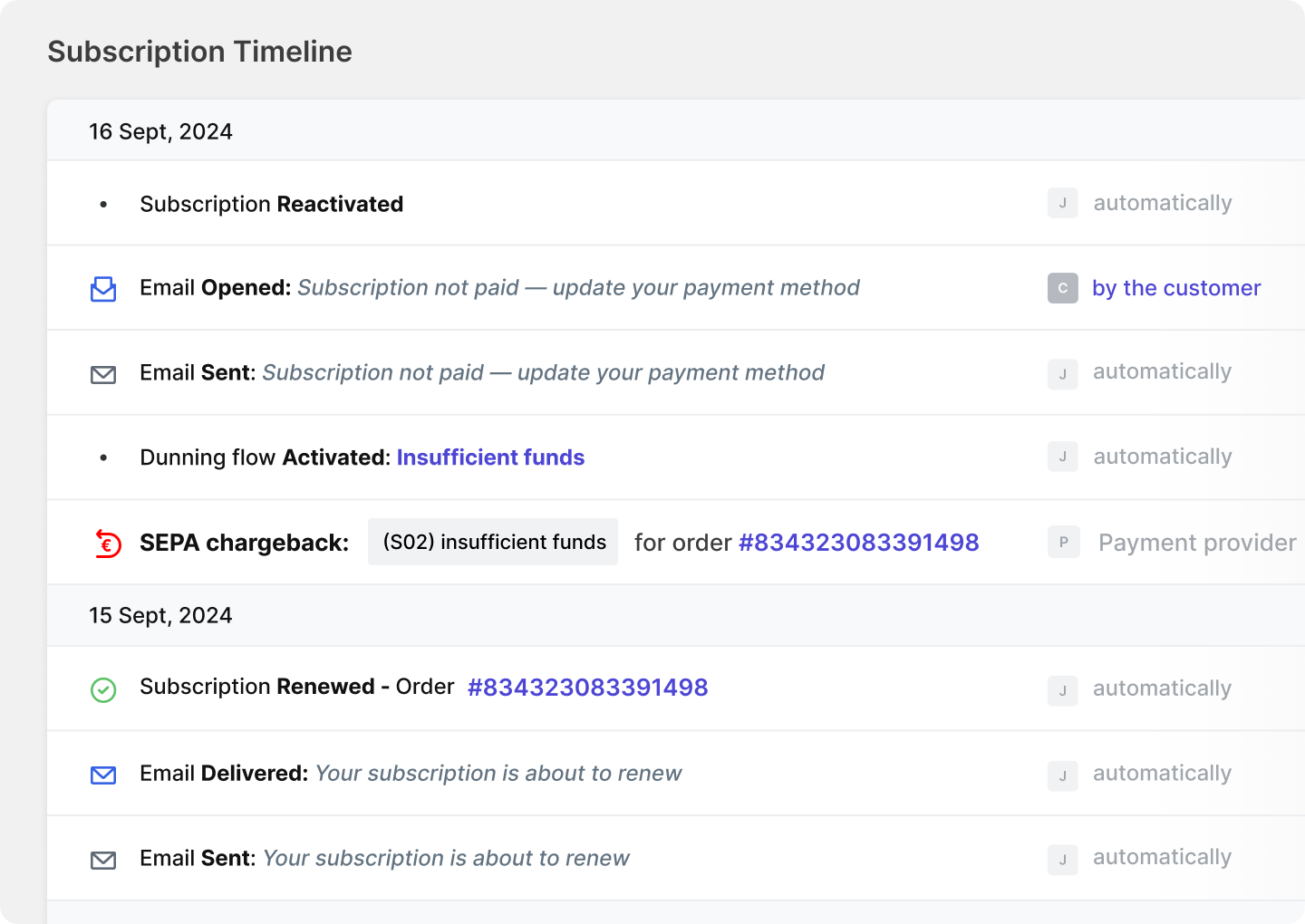

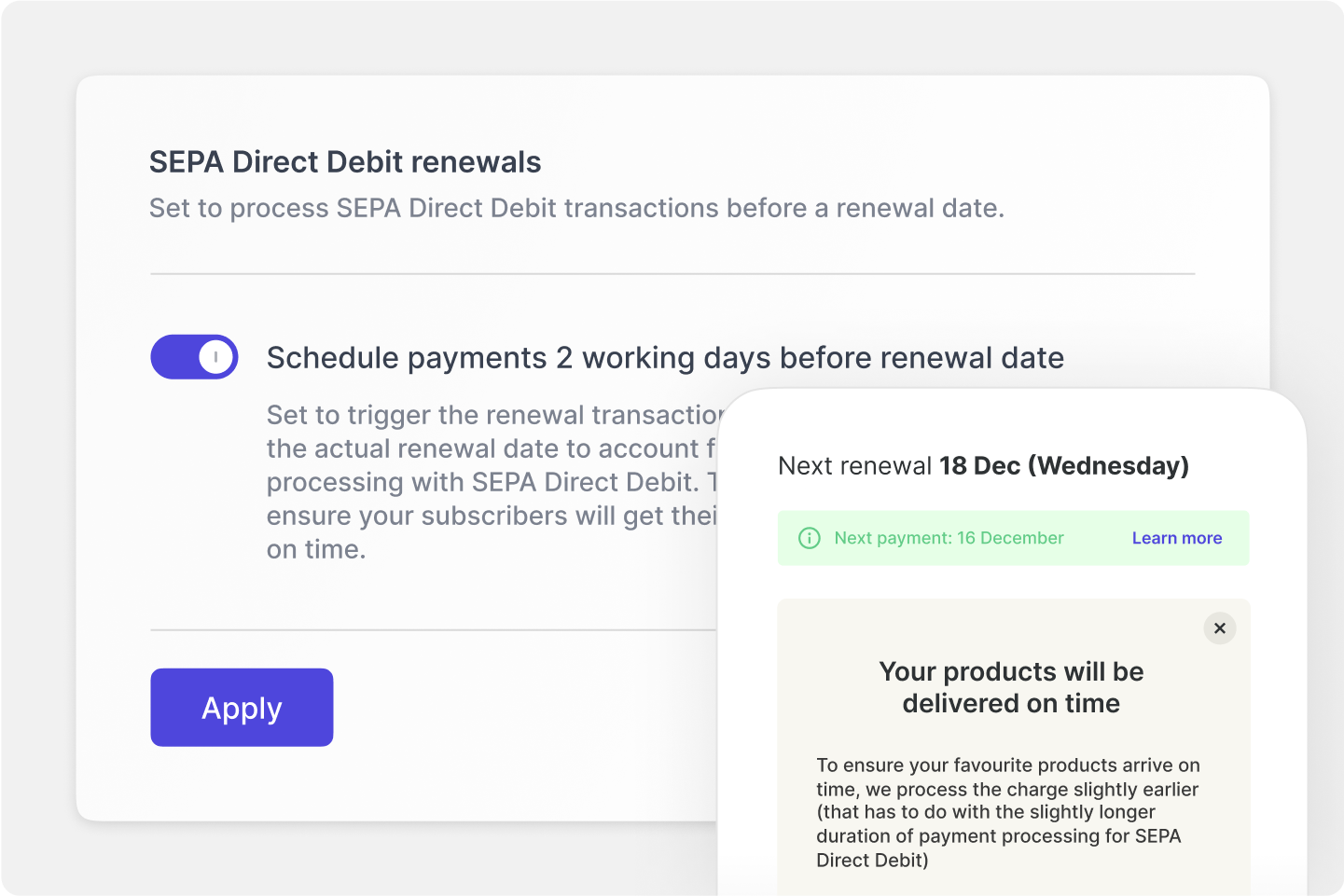

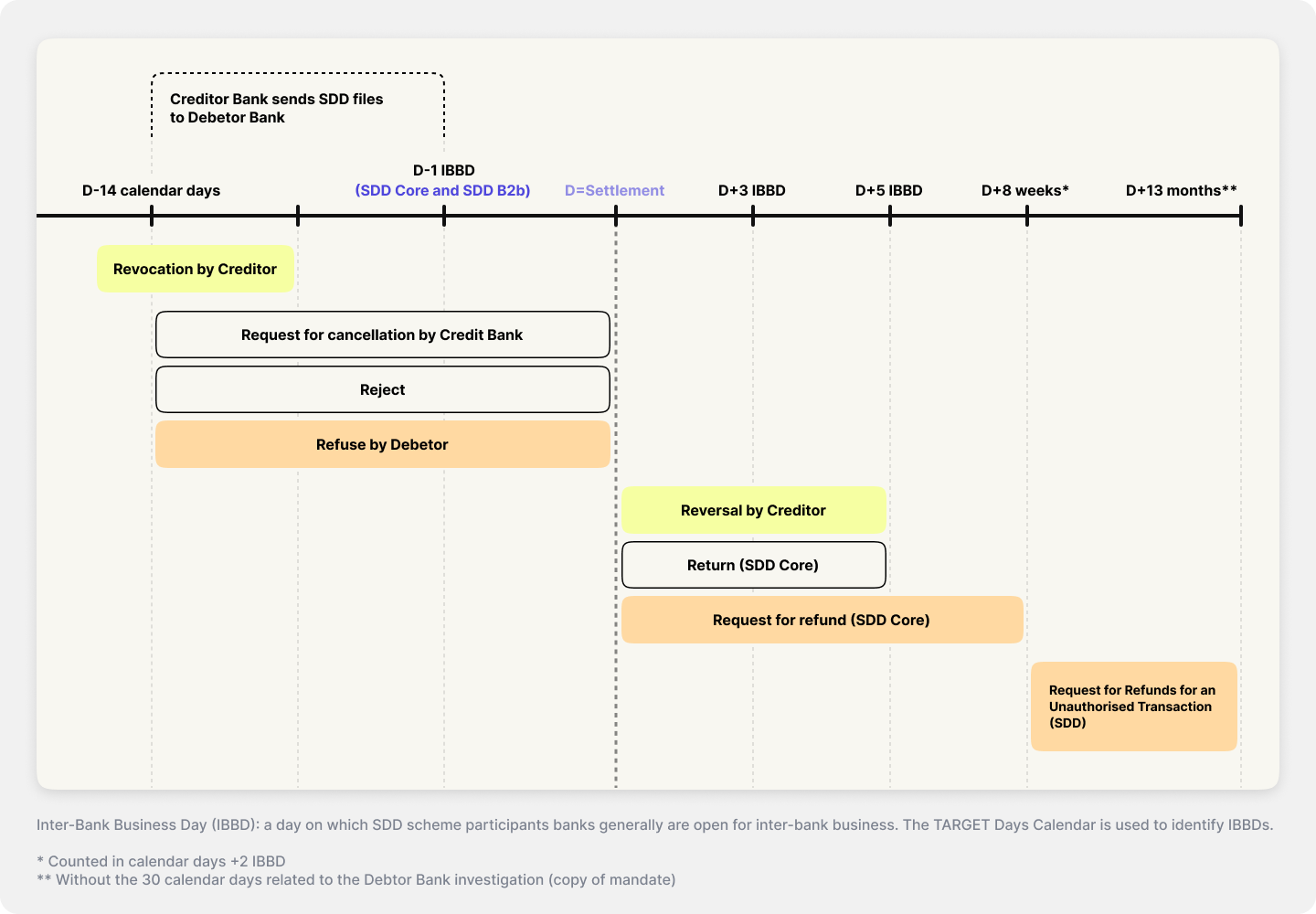

Transaction confirmation SEPA DD, being an account-to-account and merchant-initiated payment method, handles recurring transactions differently from credit cards. Payment confirmation can take 2-5 days after transaction initiation, and transactions don’t process during weekends or bank holidays. Chargebacks

There are two types of chargebacks associated with SEPA Direct Debit:

Chargebacks

There are two types of chargebacks associated with SEPA Direct Debit:

- Triggered by customer These can occur up to 90 days after the transaction, with no justification required

- Automated These occur due to various issues with customer bank accounts or mandates. This happens after the funds are credited to the merchant’s account but before the actual deduction from the buyer’s account.

To

To

For more information about SEPA check: https://www.europeanpaymentscouncil.eu/